India’s largest private sector bank, HDFC Bank, surprised markets and delighted investors by announcing its first-ever bonus issue on July 20, 2025. This historic move — a 1:1 bonus share issue — is not only significant from a shareholder perspective but also reflects deeper strategic shifts post its merger with HDFC Ltd.

Let’s break down:

Why now?

What does it mean for shareholders?

How will it impact HDFC Bank’s future

What Is a Bonus Issue?

A bonus issue is when a company issues additional shares to existing shareholders at no extra cost, based on the number of shares they already own. A 1:1 bonus means you get one extra share for every share held.

Bonus issues do not change the overall value of your investment, but they increase the number of shares you hold while the price per share adjusts downward.

Think of it as slicing a pizza into more pieces — each slice is smaller, but the total pizza remains the same.

Financial Highlights

In the first quarter of FY26, HDFC Bank reported a net profit of ₹18,155 crore, reflecting a 12% year-on-year growth, driven by stable lending income and a sharp rise in non-interest earnings. Its Net Interest Income (NII) stood at ₹31,440 crore, up 5.4% YoY, with Net Interest Margins (NIMs) at 3.35%—slightly lower due to rising deposit costs. Notably, other income more than doubled to ₹21,729 crore, supported by strong treasury gains, fee-based services, and distribution income, showcasing the bank’s ability to generate revenue beyond its core lending business.

The bank's Capital Adequacy Ratio (CAR) was a robust 18.8%, well above the regulatory requirement, highlighting financial strength and lending capacity. It also maintained a provision buffer of ₹14,400 crore, demonstrating prudent risk management. Loan growth remained steady at 6.7%, with stronger momentum in the SME segment, which grew around 17%. Overall, the results reflect a well-capitalized, diversified, and stable bank — steadily unlocking post-merger synergies while maintaining profitability and balance sheet resilience.

Why HDFC Bank’s Bonus Issue Is Unique?

1. First Bonus Issue in Its 30-Year History

Despite being one of the most profitable and investor-friendly banks, HDFC Bank had never issued a bonus share until now. It maintained a conservative capital allocation approach and preferred paying consistent cash dividends over share dilution. This makes the current 1:1 bonus not just a financial move, but a historic turning point in the bank’s shareholder communication strategy.

2. Post-Merger Strategy in Action

This bonus issue comes one year after the mega-merger with HDFC Ltd, which created one of the world’s largest financial conglomerates. The merger gave the bank a broader capital base, improved lending capacity, and access to the massive mortgage market that HDFC Ltd dominated for decades. With operational synergies kicking in, this bonus issue acts as a strategic declaration of strength and readiness to scale up retail banking dominance.

Why Did HDFC Bank Issue Bonus Shares Now?

While bonus issues may seem cosmetic at first glance, they are rarely done without strategic intent. For HDFC Bank, the decision to announce its first-ever bonus issue in 30 years of operations comes at a pivotal moment in its corporate evolution.

Let’s understand the three major reasons behind this move:

1. Strengthened Capital Position Post-Merger

One of the most fundamental prerequisites for issuing bonus shares is strong financial health, particularly adequate reserves and capital buffers. HDFC Bank checks that box emphatically.

As of Q1 FY26, HDFC Bank reported a Capital Adequacy Ratio (CAR) of 18.8%, far exceeding the minimum regulatory requirement of 11.7% (including capital conservation buffer) set by the Reserve Bank of India (RBI). This robust capital base was further bolstered by the bank's successful merger with HDFC Ltd in 2023, which gave the bank access to a larger balance sheet, increased capital efficiency, and a wider lending base.

What this means: The bank is not issuing bonus shares to mask financial weakness or distract from earnings challenges. On the contrary, the bonus is a celebration of financial strength. With ample reserves and no pressure on its capital structure, the bank can reward shareholders without compromising its ability to lend or expand.

2. To Boost Share Performance Amid Underperformance

While the fundamentals of HDFC Bank have remained strong, the stock itself has been underperforming broader indices like the Nifty50 and Bank Nifty in recent quarters. Post the HDFC Ltd merger, investors were closely watching how the integration would play out — and many felt the synergies had not yet translated into stock returns.

This is where bonus shares act as a powerful psychological trigger. Though they don’t directly increase shareholder wealth, bonus issues often improve investor sentiment and renew retail participation.

In a market environment where retail investor sentiment can sway stock movement, HDFC Bank’s bonus issue serves as a timely and strategic nudge to reignite enthusiasm, especially among retail investors who may have been waiting for a cue to re-enter.

Expert Opinions

Goldman Sachs: Margin compression observed in Q1 is likely to be temporary, according to Goldman. They expect net interest margins (NIMs) to normalize as deposit costs stabilize in the coming quarters.

Jefferies: Jefferies believes the 1:1 bonus issue is more than symbolic — it reflects confidence in post-merger strength. The firm sees this as a signal that HDFC Bank is ready to scale its next phase of growth

Nomura: Nomura forecasts consistent earnings over the next few years, supported by a well-capitalized balance sheet. It expects return on equity (ROE) to stay healthy at around 13–14.5% through FY26–28.

CLSA & Motilal Oswal: These brokerages see HDFC Bank benefiting from expanding retail credit, better cost control, and digital scale-up. They remain optimistic on long-term profitability driven by operational leverage and tech-driven distribution.

What Does This Mean for the Future?

Positive Indicators:

Integration of housing + banking expected to boost retail lending.

Focus on digital banking and semi-urban expansion.

Solid provisioning buffer of ₹14,400 crore offers stability.

Risks to Monitor:

Margin compression due to higher cost of funds.

Slower loan growth post-merger vs pre-merger years.

Competitive pressure from PSU and private peers in rural credit and digital banking.

Long-Term Growth Drivers

Expected acceleration in credit demand across home loans, SMEs, and personal loans.

Continued rise in digital payment ecosystem (UPI, credit cards, fintech partnerships).

Institutional trust, cost control, and strong CASA (Current Account-Savings Account) franchise.

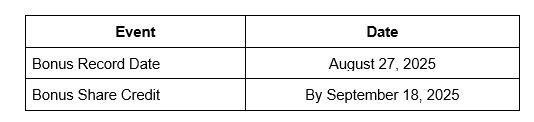

Upcoming Important Dates

Keep track of announcements on the official BSE/NSE sites or company filings.

Disclaimer

All information is sourced from publicly available data, and while every effort has been made to ensure the accuracy and reliability of the information provided in these notes from the management meeting, Ayush Agarwal Research cannot guarantee that the information is complete or free from errors.

I, Ayush Agrawal, am registered with SEBI as an Individual Research Analyst under the registration number INH000013013, effective from September 14, 2023.

I offer paid research services to my clients based on this certification. Opinions expressed otherwise regarding specific securities are not investment advice and shall not be treated as recommendations. Neither I nor my associates/ employees shall not be liable for any losses incurred based on such opinions.

All matter displayed in this content is purely for Illustrative, Knowledge and Informational purpose and shall not be treated as advice or opinion of any kind.

The content presented should not be construed as investment advice unless explicitly stated in a client-specific research report. I or my employees/associates shall not be held liable/responsible in any manner whatsoever for any losses the readers may incur due to acting upon this content.

All information is taken from publicly available sources and data. I make no warranties or guarantees regarding the accuracy, completeness, or timeliness of the information provided, including data such as news, prices, and analysis. In no event shall I be liable to any person for any decision made or action taken in reliance upon the information provided by me.

We cannot guarantee the completeness or reliability of the information presented. Readers are encouraged to conduct their own research and consult with a professional advisor before making any investment decisions.