India’s Rural Consumption: A Story of Opportunity?

8th January 2025

Pic Source: Google Images

India’s rural economy is undergoing a remarkable transformation, indicated by shifting consumption patterns and a narrowing gap between rural and urban spending. Recent data from two back-to-back Household Consumption Expenditure Surveys (HCES) for 2022-23 and 2023-24, as well as independent studies such as SBI Research, highlight the ways in which rural India is becoming more dynamic and less isolated. At first glance, the shrinking urban-rural gap in monthly per capita consumption expenditure (MPCE) might suggest a thriving farm economy. Yet, a closer look shows that a major share of rural prosperity is tied to non-farm activities, remittances, and government initiatives rather than an immediate surge in agricultural income.

Narrowing the Consumption Gap

A Decade of Change

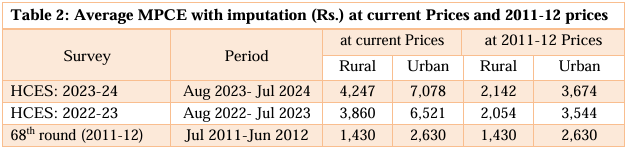

Official figures highlight that the urban-rural MPCE gap has steadily shrunk over the past decade. In 2011-12, rural MPCE was around 55–60% that of urban MPCE (an urban-rural gap of 84%). By 2023-24, that gap narrowed to about 70%. According to the Ministry of Statistics & Programme Implementation (MoSPI), rural MPCE (without imputation for free social welfare goods) now stands at $4,122 per month, while the corresponding urban figure is $6,996. Factoring in imputed values of items such as subsidized grains or free equipment offered through government schemes, the rural figure rises slightly to $4,247 and the urban figure to $7,078.

Source: MoSPI

Land Fragmentation and the Need for Diversification

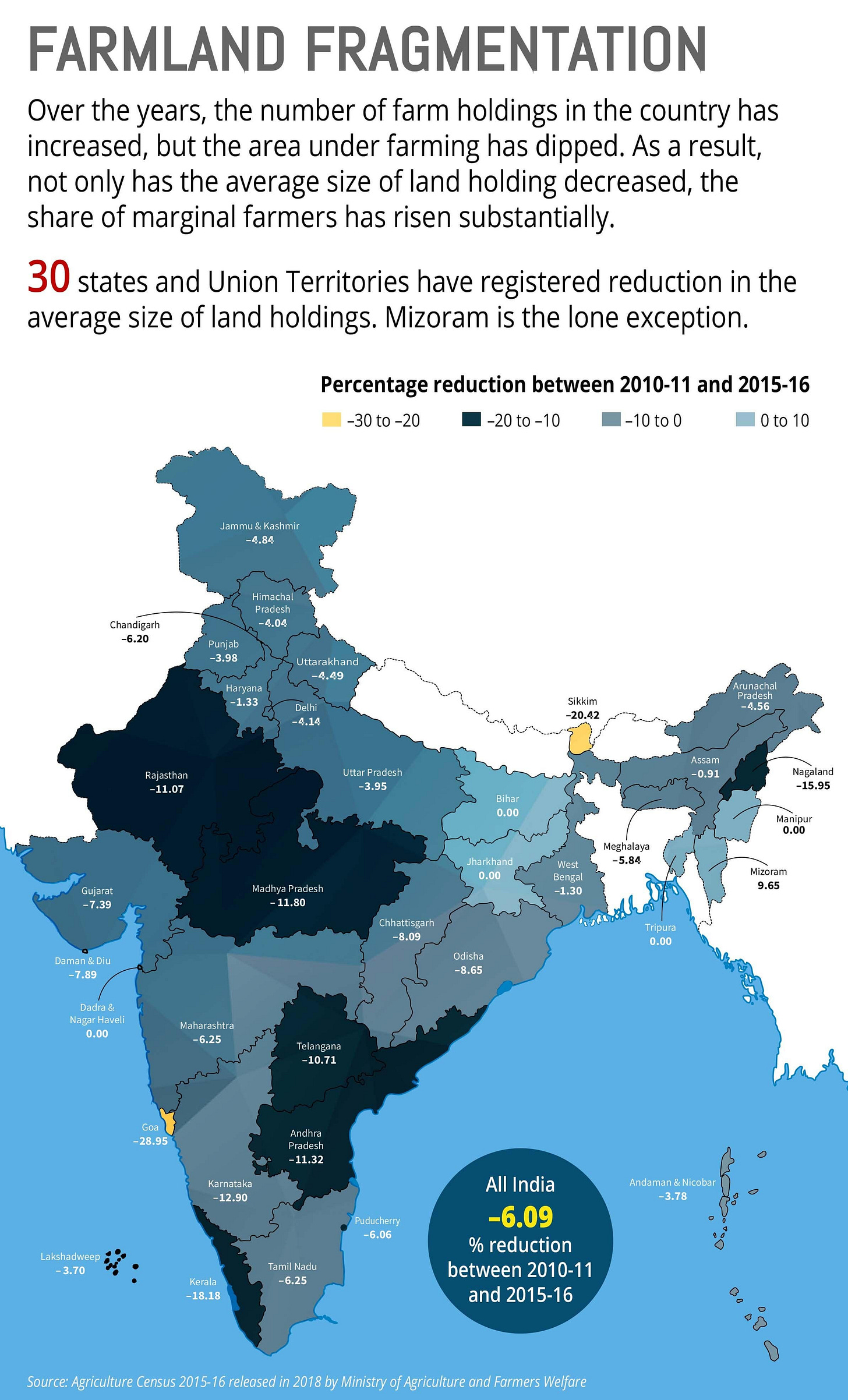

Despite the upbeat data on consumption, agriculture itself faces pressing structural challenges. With average landholding sizes having dropped from 0.725 hectares per household in 2003 to just 0.512 hectares in 2019, nearly 85% of rural families are either marginal landholders or landless altogether. This reduction in cultivable land forces many households to seek economic opportunities beyond their farms.

For agricultural households managing parcels of up to one hectare, over half of their monthly income comes from wages and non-farm businesses. As a result, land-based income alone is insufficient in driving the rise in rural consumption. Instead, a large part of the enhanced spending power in the countryside is attributable to wages and remittances from non-agricultural activities, often carried out by family members who migrate or commute for work.

Urban India as the Economic Dynamo

NITI Aayog has previously indicated that cities in India contribute about 60% of the country’s GDP. By contrast, a substantial share of the population—over 45% of the workforce—is still engaged primarily in agriculture, with more in rural non-farm occupations or self-employment. These statistics reflect the dichotomy: urban centers are creating opportunities, and rural populations are tapping into them, either by migrating temporarily or by diversifying local business activities with the help of urban demand.

What this creates is a web of economic interdependence. While agriculture remains a key sector for employment, rural families increasingly look to urban areas for their economic lifeblood. The sustained momentum of urban sectors, from construction booms to service jobs, has “pulled" rural incomes higher, narrowing the consumption gap.

Government Initiatives and Infrastructure Development

Direct Benefit Transfers and Social Welfare

One of the pivotal reasons for India’s rapidly shrinking rural-urban consumption gap is the government’s push to bolster rural livelihoods directly. Schemes offering subsidized grains (e.g., through the Public Distribution System) and free or low-cost housing, connectivity, and other essential services have directly boosted consumption at the lower end of the income spectrum.

From direct benefit transfers (DBT) to rural employment guarantees under the Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA), official interventions have ensured a safety net that not only reduces poverty but also spurs local consumption.

Enhanced Connectivity and Physical Infrastructure

Better infrastructure has empowered rural citizens to access wider markets. Improved roads, electrification, and logistics help farmers, artisans, and small entrepreneurs reach bigger, more lucrative urban markets. This, in turn, raises rural incomes and consumption. Indeed, SBI Research points out that stronger rural infrastructure is “scripting a new story in rural mobility" and is instrumental in bridging both the horizontal (rural-urban) and vertical (within-rural) income gaps.

Changing Consumption Patterns and Inequality

Non-Food Spending on the Rise

The 2023-24 HCES data reveal that, for rural households, more than half of their monthly expenditure (about 53%) goes to non-food items—a marked change from older patterns where a significant portion of rural income was spent on food. Spending on items such as clothing, transport, communication devices, and durable goods indicates that rural India’s consumption basket is diversifying in line with its urban counterparts.

Source: MoSPI

Declining Inequality

Encouragingly, inequality is down. The Gini coefficient, a measure of income or consumption inequality, dropped in rural areas from 0.266 in 2022-23 to 0.237 in 2023-24, suggesting that growth at the lower end of the economic spectrum is outpacing the upper end. The bottom 5% of rural households—when ranked by MPCE—experienced the highest percentage growth in consumption, underscoring an inclusive trend.

The rural consumption story in India today is not just about bigger harvests and better farm-gate prices; it is a multifaceted phenomenon driven by remittances, policy interventions, infrastructure improvements, and the gravitational pull of urban economic engines. While the shrinking consumption gap between rural and urban India is undoubtedly a positive sign, it reflects a broader shift in how rural households earn and spend money rather than a simple improvement in agriculture alone.

Looking ahead, the core challenge remains ensuring that this momentum is sustained—through continued government support, robust infrastructure, inclusive growth opportunities, and a resilient agriculture sector. If current trends continue, India’s villages may well see a day when the rural-urban divide in consumption is not just narrower but practically negligible, marking a robust and more equitable growth story for the country’s next chapter.

Disclaimer

All information is sourced from publicly available data, and while every effort has been made to ensure the accuracy and reliability of the information provided in these notes from the management meeting, Ayush Agarwal Research cannot guarantee that the information is complete or free from errors.

I, Ayush Agrawal, am registered with SEBI as an Individual Research Analyst under the registration number INH000013013, effective from September 14, 2023.

I offer paid research services to my clients based on this certification. Opinions expressed otherwise regarding specific securities are not investment advice and shall not be treated as recommendations. Neither I nor my associates/ employees shall not be liable for any losses incurred based on such opinions.

All matter displayed in this content is purely for Illustrative, Knowledge and Informational purpose and shall not be treated as advice or opinion of any kind.

The content presented should not be construed as investment advice unless explicitly stated in a client-specific research report. I or my employees/associates shall not be held liable/responsible in any manner whatsoever for any losses the readers may incur due to acting upon this content.

All information is taken from publicly available sources and data. I make no warranties or guarantees regarding the accuracy, completeness, or timeliness of the information provided, including data such as news, prices, and analysis. In no event shall I be liable to any person for any decision made or action taken in reliance upon the information provided by me.

We cannot guarantee the completeness or reliability of the information presented. Readers are encouraged to conduct their own research and consult with a professional advisor before making any investment decisions.