My 2 cents on Ather Energy

17th August 2025

Ather is one of the rare “pure-play tech-first EV stories” that’s beginning to scale with substance. As a Bengaluru-based brand that owns its software, hardware, batteries, and charging infra, I see Ather executing a classic move: from early-stage disruptor to a repeatable growth engine.

The Q1 FY26 results are the first real proof point—now the next critical move is turning that growth into sustained profitability and regional dominance.

1. Tech-First DNA & Ecosystem Moat

For me, vertical integration isn’t a marketing line—it’s a real competitive edge. Because Ather designs its software, battery, and vehicle systems in-house, it can control cost, quality, and push OTA upgrades—features very few Indian EV players can claim.

I don’t see the ecosystem as “just scooters.” It’s software services, charging access, and brand imprint. This creates what I’d call monetizable loyal demand—AtherStack Pro subscriptions and accessory sales give stickiness to the brand beyond hardware.

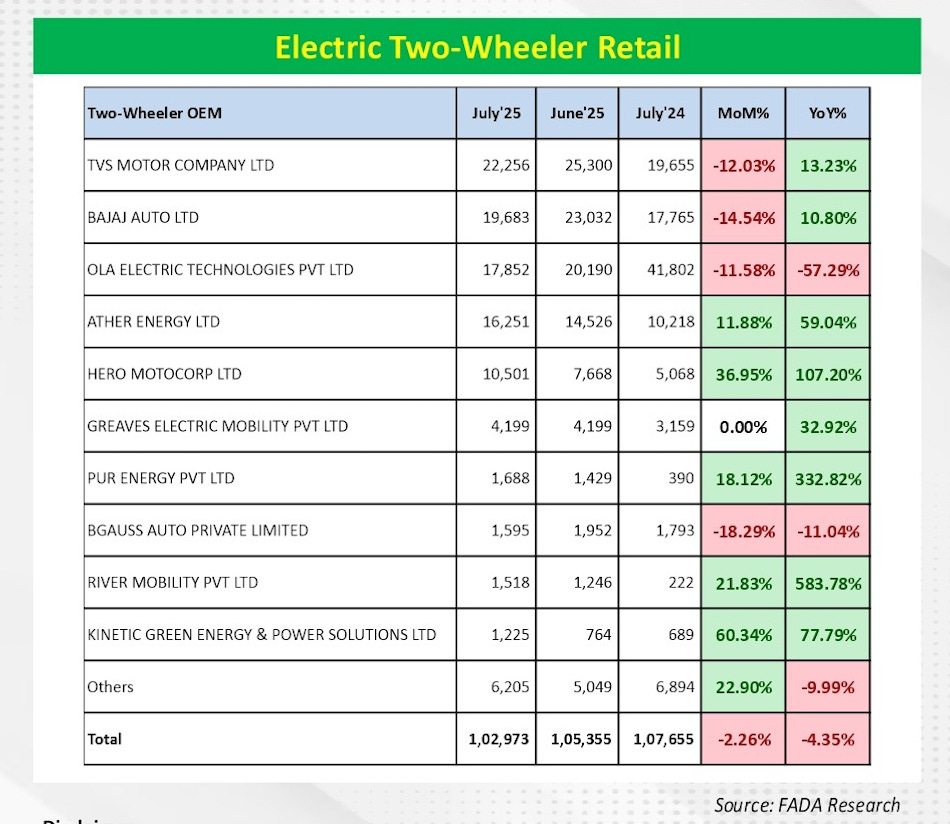

2. Volume Surge and Reach

In Q1, volumes leapt 97% YoY to 46,078 units, driven by Rizta’s success and 95 new Experience Centres (ECs) added in just one quarter—taking the network to 446 ECs.

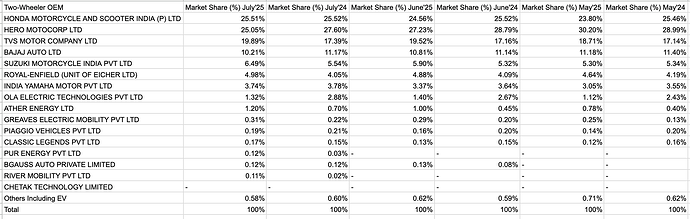

Revenue moved in tandem, up 79–83% YoY (~₹645–673 crore). Market share nearly doubled—14.3% nationally, 22.8% in South India, and 10.7% in Middle India (Gujarat, MH, MP, Odisha, etc.).

3. Margin Trajectory Turning the Corner

Adjusted gross margin jumped 117% YoY to ₹155 crore, implying ~23%.

EBITDA loss narrowed sharply—margin improved ~1,700 bps to -16%. Nomura’s estimate of ~19.6% gross margin proved conservative; they expect break-even by mid-FY28 and eventual ~28% margins, in line with traditional 2W peers.

4. Retail & Infra Reach – Scale Meets Execution

To me, EC expansion isn’t a footnote—it’s how Ather lowers breakeven, builds trust, and wins Tier 2/3 mindshare.

Charging infra crossed 4,000 fast points across India, Nepal, and Sri Lanka—a tangible network edge.

Next-gen upgrades are on the way: EL platform (cost-efficient architecture), Ather Stack 7, and Factory 3.0 in Maharashtra, which should ramp capacity toward ~1.4 million units annually.

5. Risks – As Real As They Get

The profitability path won’t be linear. Cash burn is still real—losses at ₹178 crore (vs ₹183 crore YoY).

I also see supply-side risk: China’s export ban on rare-earth magnets could disrupt production—Nomura notes a 7-day supply cushion.

Competition is intense—TVS, Bajaj, Ola Electric aren’t slowing. Ather’s software-first edge is valuable, but sustaining that at scale is the real test.

And finally, the IPO hangover is alive—the debut was muted and slightly overpriced, so volatility is inevitable if execution slips.

6. Customer-Focused Financing & Ownership Innovations

This is where Ather, in my view, steps beyond hardware and UX into building ownership psychology and affordability—that much-needed human touch in the EV story.

Battery as a Service (BaaS)

Launched in mid-August 2025, Ather now lets customers buy the shell only and subscribe to the battery usage at ~₹1 per km for a 48-month plan, with a minimum of 1,000 km/month .

The Rizta shell starts at ₹75,999, and the 450 Series at ₹84,341 (ex-showroom Lucknow)—representing a ~30% reduction in upfront cost.

This structure defrays the biggest psychological and financial hurdle: buying high-cost EV batteries. For finance-conscious Indian families, that could shift EV purchase intent materially.

Assured Buyback Programme

Extended to a wider customer base and now guarantees up to 60% of scooter value after 3 years, and 50% after 4, depending on usage .

Resale value anxiety has always been a loud deterrent in EV adoption. This moves Ather toward owning that second-hand narrative—critical for mass adoption in India.

Extended Comprehensive Warranty (ECW)

Covers up to 11 critical components—motor, controller, charger, dashboard—for 5 years or 60,000 km, whichever is earlier. Only available with AtherStack Pro subscribers.

This takes away key maintenance fears—most genuine users believe EV is lower maintenance, but pricey component failure can ruin that thesis. This extended cover builds faith.

7. Valuation & Medium-Term Outlook

At ~2.6x EV/Sales (FY28), valuation is in line with TVS, but with a growth premium. Consensus expects volumes to CAGR ~41% FY25–28 (~155k to 436k units).

If Ather delivers on that while steadily lifting margins, I believe a re-rating toward peer multiples is very credible.

Market Share of all EVs of last 3 months YoY and MoM

Edited on 2nd September 2025

Registration granted by SEBI and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Investment in securities market are subject to market risks. Read all the related documents carefully before investing.

Disclosure : Not an investment advise/ recommendation. Please consult a Registered Investment Advisor before Investing.

Rgds,

Ayush Agrawal

Disclaimer

All information is sourced from publicly available data, and while every effort has been made to ensure the accuracy and reliability of the information provided

I, Ayush Agrawal, am registered with SEBI as an Individual Research Analyst under the registration number INH000013013, effective from September 14, 2023.

Opinions expressed otherwise regarding specific securities are not investment advice and shall not be treated as recommendations. Neither I nor my associates/ employees shall not be liable for any losses incurred based on such opinions.

All matter displayed in this content is purely for Illustrative, Knowledge and Informational purpose and shall not be treated as advice or opinion of any kind.

The content presented should not be construed as investment advice unless explicitly stated in a client-specific research report. I or my employees/associates shall not be held liable/responsible in any manner whatsoever for any losses the readers may incur due to acting upon this content.

All information is taken from publicly available sources and data. I make no warranties or guarantees regarding the accuracy, completeness, or timeliness of the information provided, including data such as news, prices, and analysis. In no event shall I be liable to any person for any decision made or action taken in reliance upon the information provided by me.

We cannot guarantee the completeness or reliability of the information presented. Readers are encouraged to conduct their own research and consult with a professional advisor before making any investment decisions.