My 2 cents on Utkarsh Small Finance Bank

26th October 2025

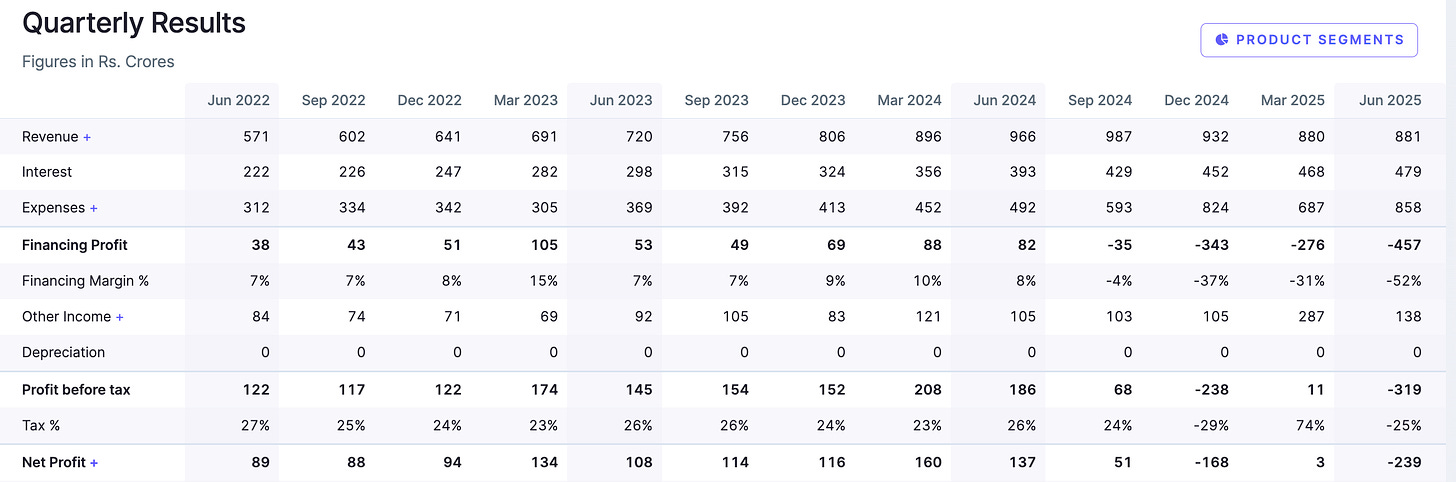

Can a bank that just posted a ₹239 crore loss do a successful turnaround?

The Good News:

The bank operates 1,099 branches across 27 states and union territories, making it one of the largest small finance bank networks in India

Deposits grew 18% year-on-year to ₹21,489 crore, showing people still trust the bank with their money

Strong liquidity with ₹3,900 crore surplus and a Liquidity Coverage Ratio of 219% (think of this as having plenty of cash in hand)

Capital Adequacy Ratio of 19.6%—well above the regulatory requirement (the bank has enough cushion to absorb losses)

The Bad News:

Posted a net loss of ₹239 crore in Q1 FY26 versus a profit of ₹137 crore in Q1 FY25

Gross Non-Performing Assets (bad loans) jumped to 11.4% from just 2.8% a year ago

The microfinance business—their traditional strength—is bleeding

What Went Wrong?

The industry faced a perfect storm in FY25:

Over-lending: Multiple lenders gave loans to the same borrowers. Some people had loans from 4-5 different institutions. When you’re earning ₹10,000 a month and owe ₹50,000 across different lenders, it becomes impossible to repay.

Climate Issues: Heat waves and erratic monsoons disrupted the income of borrowers dependent on agriculture and allied activities.

Regulatory Guardrails: In July 2024, the industry self-regulator MFIN capped the number of lenders per borrower to 4, then reduced it to 3 from April 2025. This meant many borrowers couldn’t get fresh loans to repay old ones—a practice called “loan recycling” that was keeping the system afloat.

The Dirty Picture

Nearly 20% of microfinance loan portfolios across small finance banks were at risk as of June 2025

For Utkarsh specifically, Portfolio at Risk (PAR) for 30+ days stood at 23.23%—meaning nearly 1 in 4 borrowers hadn’t paid for over a month

Collection efficiency (excluding pre-payments) fell to just 82% in Q1 FY26

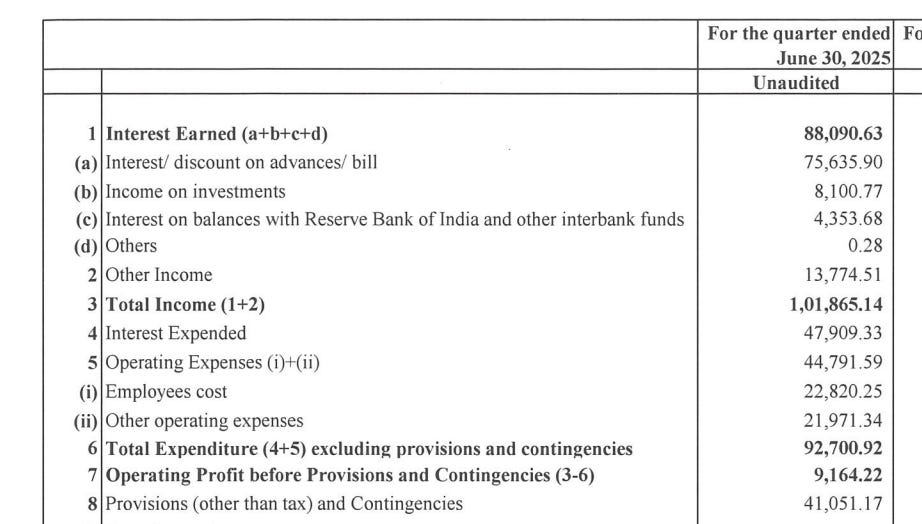

Utkarsh reported high provisions (money set aside for potential losses) of ₹411 crore in Q1 FY26, wiping out operating profits and creating a loss.

What the Management is Doing:

The management is doing three things.

1. Shifting from Risky to Safer Loans

The bank is deliberately reducing its microfinance (JLG) portfolio and growing secured loans instead.

JLG (microfinance) loans: Down 28% year-on-year to ₹7,613 crore (Q2 FY26)

Non-JLG loans: Up 30% to ₹11,042 crore

Secured loans now make up 45% of the total loan book, up from 35% a year ago

Management target: Take secured loans to over 50% in 2-3 years

Secured Loans are loans backed by collateral—something tangible the bank can recover if the borrower defaults:

MSME loans: Loans to small businesses, grew 46% year-on-year

Housing loans: Up 30% year-on-year

Vehicle loans (Wheels): Growing 17% annually, with focus on used vehicles

Micro-LAP (Loan Against Property): Small loans secured by property

These loans typically have better recovery rates because there’s an asset backing them.

2. Building a Rock-Solid Deposit Base

While the loan side is troubled, the deposit side is thriving:

Retail Term Deposits: Up 34% year-on-year to ₹12,257 crore

CASA (Current + Savings Account): Up 22% to ₹4,478 crore

CASA Ratio: Improved to 20.9% from 19.6%

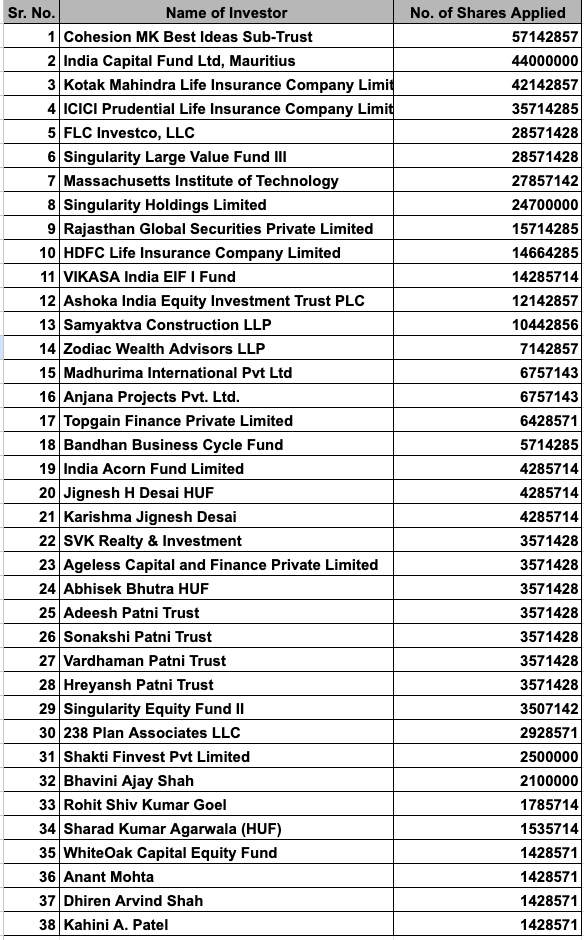

3. Raising Fresh Capital

The Bank’s Board approved a rights issue of up to ₹950 crore at ₹14 per share—a steep 37.5% discount to the then-prevailing market price.

Entitlement Ratio: 8 shares for every 13 shares held

Record Date: October 14, 2025

Issue Period: October 24 to November 3, 2025

Purpose: Strengthen Tier-1 capital, absorb credit costs, and fund secured loan growth

On October 24, 2025, the bank announced a list of investors participating in the rights issue:

The Worst Is Behind Them?

While Q1 FY26 was brutal, Q2 FY26 data shows early signs of stabilization:

Collection Efficiency:

This is a massive improvement from the 82% in Q1 FY26

What This Means:

When collection efficiency improves, it suggests borrowers are starting to repay regularly again. If this trend holds, provisions (and losses) will come down in subsequent quarters.

Management’s Guidance:

Q2 FY26 credit costs will remain elevated (similar to Q1)

From Q3 FY26 onwards, expect credit costs to decline

The bank expects to reach 99-99.5% X-bucket collection efficiency and stabilize disbursements in 3-4 months

Industry-Wide Recovery:

The entire microfinance sector is showing similar green shoots:

Portfolio at Risk (PAR 31-60 days) for the sector dropped to 1.1% from 1.6% in December 2024

PAR 61-90 days improved to 1.4% from 1.6%

Early delinquency indicators are trending in the right direction

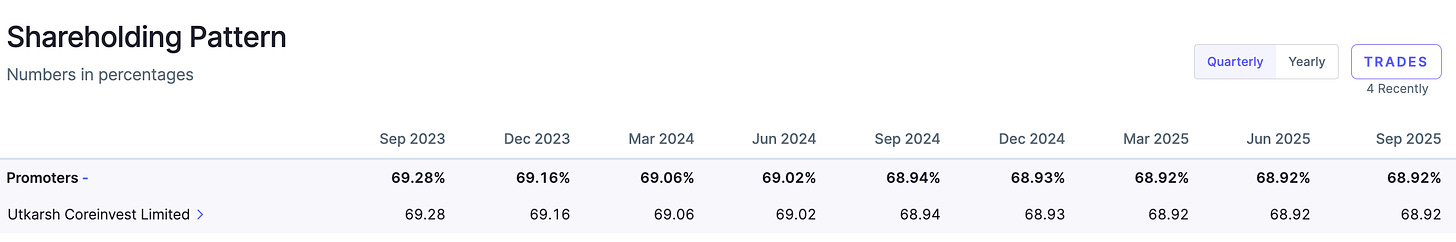

Reverse Merger: Utkarsh CoreInvest Limited (UCL)

UCL (the parent company holding 68.92% stake) will merge into Utkarsh Small Finance Bank.

Status:

RBI approval: ✅ Received (January 2, 2025)

NSE and BSE no-objection: ✅ Received (July 2025)

SEBI approval: ⏳ Pending

NCLT approval: ⏳ Pending

Expected completion: By Q3-Q4 FY26

The stock is trading very close to its book value—the accounting value of the company’s net assets. For a bank, this often signals deep distress OR a deep value opportunity, depending on view of the turnaround.

At ₹14 per share, the rights issue offers a 35.48% discount to the last close and a 16.17% discount to book value.

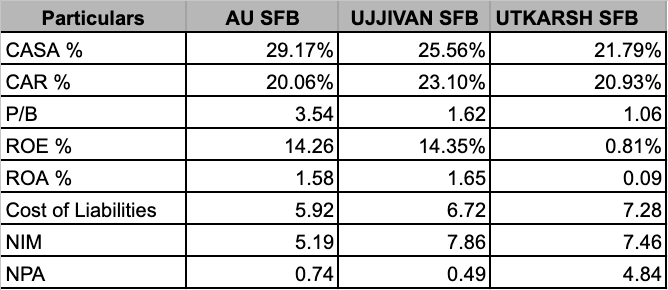

Peer Comparison:

The Risk Factors

1. Prolonged MFI Stress:

What if the microfinance stress doesn’t ease as quickly as management expects? If collection efficiency doesn’t improve by Q3 FY26 as guided, losses could continue into FY27.

2. Execution Risk:

Scaling secured lending requires different skills than microfinance. Can the bank maintain underwriting standards while growing MSME, housing, and vehicle loans aggressively?

3. Dilution Fatigue:

The rights issue will dilute existing shareholders. If asset quality doesn’t improve, there could be another round of capital raising in FY27, leading to further dilution.

4. Rating Pressure:

Rating Agencies downgraded the bank’s subordinated debt in August 2025. Any further downgrades could increase the cost of funds, hurting profitability.

5. Competitive Pressure:

AU Small Finance Bank, Ujjivan, and even large banks are targeting the same MSME and affordable housing segments.

6. Liquidity Crunch in the Sector:

The broader microfinance sector is facing a funding crunch. Bank credit to NBFC-MFIs fell 38% in FY25. If this continues, even healthy lenders may struggle to grow.

My 2 cents:

1. Deep Value Play:

At 1.06x P/B, the stock is trading near distressed levels, if asset quality stabilizes and the bank returns to even modest profitability, a re-rating can be on cards.

2. Management Credibility:

CEO Govind Singh has been transparent about the challenges and has laid out a clear roadmap:

Shift to secured loans (already 45% of the book)

Reduce JLG exposure cautiously

Target 8.5% Net Interest Margin in 2-3 years

Aim for 15%+ ROE once the turnaround is complete

3. Operating Leverage:

The bank has 1,099 branches with 41% of them less than 3 years old. As these branches mature and deposit/loan ratios improve, operating efficiency will increase without needing massive new infrastructure investments.

4. Digital Transformation:

The bank is upgrading to Finacle core banking, implementing ML-based collection workflows, and automating processes. This should reduce operating costs and improve asset quality monitoring.

5. Capital Inflow:

The Bank’s Board has approved a rights issue of up to ₹950 crore

6. Regulatory Tailwinds:

In June 2025, RBI reduced the Priority Sector Lending requirement for small finance banks from 75% to 60%. This gives Utkarsh more freedom to diversify into higher-margin, lower-risk corporate and mid-market loans.

Key Things to Watch Out for:

Q2 FY26 results (November 2025): Lookout for credit cost guidance

Q3 FY26 results (February 2026): This is the make-or-break quarter per management guidance

Reverse merger completion: Expected by Q3-Q4 FY26

Two consecutive quarters of improving asset quality

Collection efficiency sustaining above 98%

Secured loan portfolio crossing 50% of total book

On the whole, Utkarsh’s story is part of a larger narrative about financial inclusion in India.

15 crore low-income households in India need access to credit

MSMEs contribute 30% to GDP but face a credit gap of $5.7 trillion globally

Small finance banks bridge the gap between traditional banks and microfinance NBFCs

The bank faces genuine, serious challenges—11.4% GNPA is no joke.

But it also has genuine, tangible strengths: a massive branch network, a growing deposit base, strong liquidity, and now a war chest of fresh capital.

The bull case: If collection efficiency improves as management expects, credit costs will decline from Q3 FY26. The shift to secured loans will gradually improve the risk profile. As profitability returns, the stock could re-rate.

The bear case: Microfinance stress persists longer than expected. Fresh NPAs emerge in secured lending due to rapid scaling. The bank needs another capital raise leading to further dilution and investor fatigue.

Disclaimer

All information is sourced from publicly available data, and while every effort has been made to ensure the accuracy and reliability of the information provided in these links, Ayush Agarwal cannot guarantee that the information is complete or free from errors.

I, Ayush Agrawal, am registered with SEBI as an Individual Research Analyst under the registration number INH000013013, effective from September 14, 2023.

I offer paid research services.

Opinions expressed regarding specific securities are not investment advice and shall not be treated as recommendations.

Neither I nor my associates/ employees shall be liable for any losses incurred based on such opinions.

All matter displayed in the above content is purely for Illustrative, Knowledge and Informational purposes and shall not be treated as advice or opinion of any kind.

The content presented should not be construed as investment advice.

I nor my employees/associates shall be held liable/responsible in any manner whatsoever for any losses the readers may incur due to acting upon this content.

All information is taken from publicly available sources and data. I make no warranties or guarantees regarding the accuracy, completeness, or timeliness of the information provided, including data such as news, prices, and analysis.

We cannot guarantee the completeness or reliability of the information presented.

Readers are encouraged to conduct their own research and consult with a professional advisor before making any investment decisions.

In no event shall I be liable to any person for any decision made or action taken in reliance upon the information provided by me.

I, Ayush Agrawal, expressly disclaim liability for any direct or consequential losses from reliance on this content.

Registration granted by SEBI and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Investment in securities market are subject to market risks. Read all the related documents carefully before investing.

The Above Information is for illustrative Purposes only and not a Recommendation.

Please consult a Registered Investment Advisor and do your own due diligence before maying investment decisions.

Compliance officer: Ayush Agrawal

Telephone number: +91 9425412028.

E-mail address: themicrocapinvestor@gmail.com

Contact Details

themicrocapinvestor@gmail.com

First Floor, B.P. Complex, Baldeobagh, Jabalpur, Madhya Pradesh, 482002

+91 9425412028

SEBI Research Analyst No. : INH000013013

BSE Enlistment No. : 5849