Hello Dear Reader,

Welcome to the AARD Phoenix. This is the first issue of our newsletter series at Ayush Agrawal Research where I will on a weekly basis give out 2-3 Technical Picks and a Fundamental Pick.

I will not want put this newsletter behind a paywall and ask you for money to ever access this letter. You can even read this newsletter if you do not subscribe to The Microcap Minute.

I also do not have plans to bore you a lot with general market commentary or send you AI based summaries of corporate announcements. This will be a pointed newsletter where each issue will have a few picks given by a SEBI Registered RA and anyone of you, even as you read this letter years from today can access it without even subscribing to the newsletter or even giving your email or contact details.

SHRIRAM PISTONS Technical Setup

Analysis: 6-week flat base breakout possibility

Entry Zone: 2610-2740

Upside: 25% from Entry Range

Stop Loss: 7% from Entry Range

Time Frame: 6 months

AFFLE Technical Setup

Analysis: 9-week flat base breakout possibility

Entry Zone: ₹2,075 - ₹2,184

Upside: 25% from Entry Range

Stop Loss: 7% from Entry Range

Time Frame: 6 months

Company Name - JK Cement

Entry Zone: ₹6573 - ₹6757

Upside: 22% from Entry Range

Stop Loss: 7% from Entry Range

Time Frame: 24 months

About Company:

Founded in 1994, JKCL today is among India’s most prominent manufacturers of both grey and white cement. As of June 2025, its installed grey cement capacity stood at 25.3 million tonnes, while white cement and wall putty capacity (including India and UAE operations) reached 3.05 million tonnes. With plants spread across the north, central, west, and south, and a new presence in the east via TCPL, the company has built a diversified and strategically balanced manufacturing base.

JK Cement Ltd. (JKCL) ranks among India’s top 10 grey cement producers, with a well-entrenched presence across the northern, central, southern, and western markets, and an expanding base in the east following its FY24 acquisition of TCPL. Its reach extends across 22 states, backed by a strong distribution network of over 92,000 channel partners, giving the company a true pan-India footprint.

About The Management

Dr. Raghavpat Singhania, aged 40 is a Graduate from Sheffield Hallam University with a Doctorate Degree. He has rich experience in the grey and white cement industry. He joined JKCL as a special executive in 2007 and currently serves as Managing Director.

Mr. Madhavkrishna Singhania, aged 36 is a Bachelor’s degree holder in Electrical & Computer Engineering from Carnegie Mellon University, USA, and a has a Diploma in Family Business Management from IMD Lausanne, Switzerland. He joined JKCL as a special executive in 2010 and currently serves as Managing Director and currently serves as Joint Managing Director & Chief Executive Officer.

Mr. Ajay Kumar Saraogi, aged 68 serves as Chief Financial Officer joined the company in 1978 making him older in service than both current Singhania leaders combined. He has witnessed the entire transformation from Yadupati's early days to the current fourth generation, providing nearly 50 years of service.

His presence on 10+ company boards spans the entire JK ecosystem including paints, pigments, and various subsidiaries makes me believe he serves as the financial guardian of the JKCL empire.

Business Analysis:

In northern India, JKCL is the fifth-largest cement player, while in central India it has climbed to the third position after commissioning its greenfield unit at Prayagraj in June 2024.

Globally, JKCL is also a leader in the white cement business, with a total capacity of 1.7 million tonnes per annum, including that of its subsidiary. It is the second-largest producer of white cement and wall putty in India, supported by a specialized dealer network across the country.

The white cement segment, which requires high-grade limestone and specialised distribution, offers high entry barriers and commands a price premium over grey cement. This strength has enabled JKCL to deliver one of the highest blended realisations and EBITDA per tonne in the sector, second only to the top market players.

The company is executing an aggressive yet prudent capacity expansion, aiming to almost double its grey cement capacity from ~24.34 MnTPA in FY 2024-25 to 50 MnTPA by 2030.

Further plans include increasing cement grinding capacity by 6.0 MnT across Bihar, Panna, Hamirpur, and Prayagraj by end-December 2025, with scheduled commercial operation by March 2026

JKCL has also strategically acquired a 60% stake in Saifco Cements Private Limited, effective from June 6, 2025, providing access to an integrated unit with 0.26 MnTPA clinker and 0.42 MnTPA cement grinding capacity in Jammu & Kashmir.

The company expects to achieve INR 40-50 per tonne in cost savings during FY26, with green power share anticipated to reach approximately 60% by the end of FY26

For FY 2024-25, JKCL reported revenue from operations of INR 11,093 Crores and an EBITDA of INR 1,978 Crores, with its EBITDA per tonne of INR 1,017 remaining among the best in the industry.

Its white cement and wall putty segments contribute 19% to the revenue mix and the company is one of the top two players in wall putty manufacturing. The paint business recorded a turnover of INR 273 Crores in FY25 and INR 86 Crores in Q1 FY26, with management targeting INR 600 Crores revenue and breakeven by FY27.

JKCL maintains a strong balance sheet with a healthy debt-to-equity ratio of 0.97 as of March 31, 2025.

On August 7, 2025, India Ratings and Research (Ind-Ra) affirmed JKCL’s bank loan facilities at ‘IND AA+’/Stable.

As per Common Size Analysis:

Borrowings has actually gone down YoY in FY25 as a % of Total Liabilities

Reserves have increased as a % of Total Liabilities

Advances from customers have increased as a % of Total Liabilities

Cash Equivalents are up as a % of Total Assets

Doing Ratio Analysis:

Debt to Equity is down YoY as of 31st March FY25

Both inventory turnover and receivable turnover have witnessed a decline. This can be concerning.

What I find fascinating is the Net Profit Margin which has gone up from 4.28% in FY23 to 8.15% TTM.

Dupont ROE Analysis:

For every Rs. 100 in sales, JKCL kept Rs ₹7.34 as of 31st March 2025 and Rs. 8.15 TTM. This was Rs. 4.28 in FY23.

For every asset of Rs. 100, JKCL generated Rs. 71 worth of sales as of 31st March 2025.

For every ₹1 of owner's money, the company has borrowed an additional ₹1.74.

Big Money Analysis:

FIIs have upped their holding in the company as of June 2025 quarter.

PE Analysis:

If we take the TTM PE of 28 players in the industry, it comes at 58.44x. JK Cement trades at 55.2x which is below industry PE.

Working Capital Analysis:

The cash cycle of the company has gone down from 78 to 38 in FY25.

Reverse DCF:

Taking the TTM PAT of 1,011 cr at TTM PE of 55.64x, at a 12% discount rate, at an exit PE assuming the 5Yr Average as the exit value, market is giving it an implied growth rate of 15.63%.

This is just an assumption. Nothing else. Please DYODD and if you take any positions in stocks respect buy range and Stop Losses.

Social Media Disclaimer

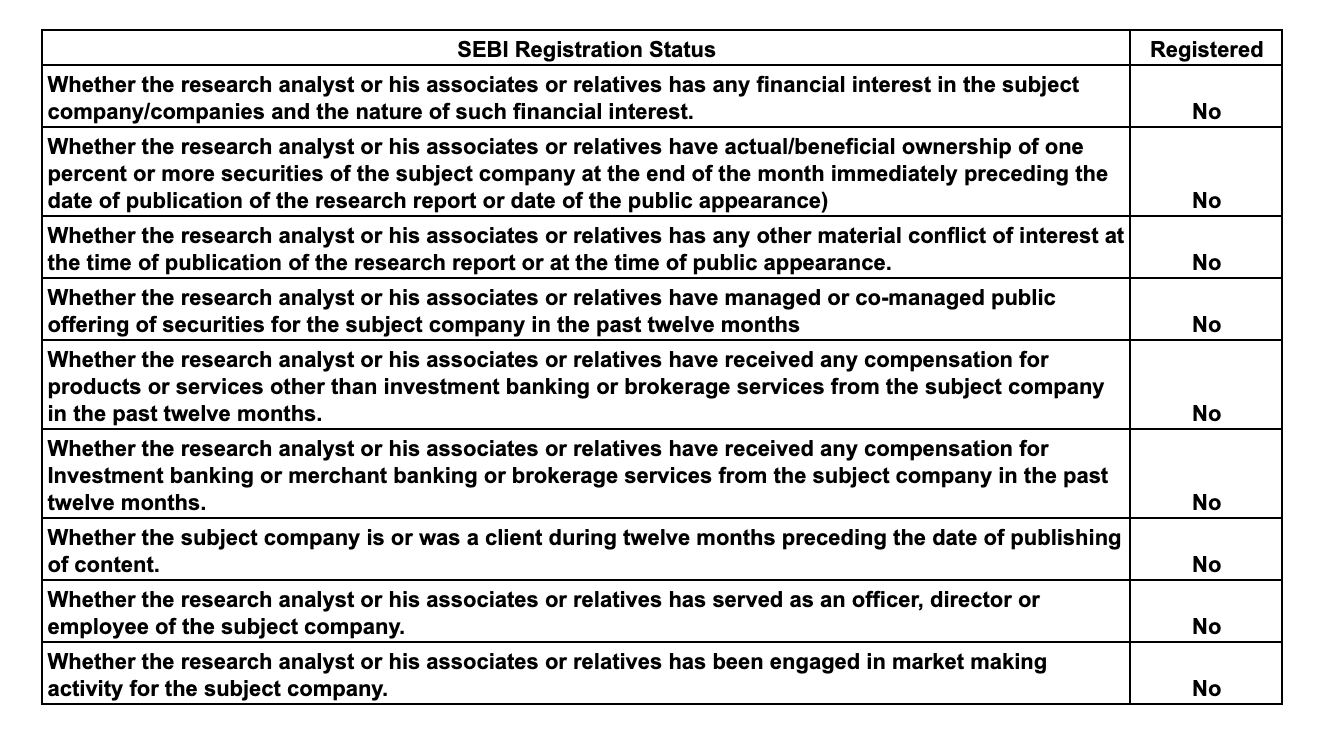

The content shared here reflects the personal views of Ayush Agrawal, who is registered with SEBI as an Individual Research Analyst (INH000013013, w.e.f. September 14, 2023).

All market opinions, stock ideas, and recommendations are provided purely for informational purposes and as general research under SEBI “public appearance” guidelines.

Nothing here is to be construed as personalised financial advice.

Recommendations and analyses are not tailored to individual financial circumstances, objectives, or risk profiles; they do not constitute specific advice or a contract of service.

I, Ayush Agrawal, do not currently offer any paid research or advisory services. No consideration of any kind is received for securities or products mentioned, and there is no beneficial ownership or trading position in the discussed securities in the last 30 trading days, nor is any planned within the next 5 trading days.

All information has been sourced from public data considered reliable, but accuracy, completeness, and timeliness are not guaranteed.

Manual errors or omissions may exist. Independently verify all data before investing.

Readers/investors must do their own due diligence or consult a licensed advisor before taking any action based on these views.

I, Ayush Agrawal, expressly disclaim liability for any direct or consequential losses from reliance on this content.

Registration granted by SEBI and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Investment in securities market are subject to market risks. Read all the related documents carefully before investing.

Compliance officer: Ayush Agrawal

Telephone number: +91 9425412028.

E-mail address: themicrocapinvestor@gmail.com

Contact Details

themicrocapinvestor@gmail.com

First Floor, B.P. Complex, Baldeobagh, Jabalpur, Madhya Pradesh, 482002

+91 9425412028

SEBI Research Analyst No. : INH000013013

BSE Enlistment No. : 5849