Hello Dear Reader,

Welcome to the AARD Phoenix. This is the second issue of our newsletter series at Ayush Agrawal Research where I will on a weekly basis give out 2-3 Technical Picks occasionally a Fundamental Pick.

Thanks for reading The Microcap Minute! Subscribe for free to receive new posts and support my work.

I will not want put this newsletter behind a paywall and ask you for money to ever access this letter. You can even read this newsletter if you do not subscribe to The Microcap Minute.

I also do not have plans to bore you a lot with general market commentary or send you AI based summaries of corporate announcements. For that, I have a Free WhatsApp community where I post all the important Corporate Announcements Daily. You can Join Below:

This will be a pointed newsletter where each issue will have a few picks given by a SEBI Registered RA and anyone of you, even as you read this letter years from today can access it without even subscribing to the newsletter or even giving your email or contact details. Please though remember that nothing here is to be construed as personalized financial advice. Recommendations and analyses are not tailored to individual financial circumstances, objectives, or risk profiles; they do not constitute specific advice or a contract of service. Please do your own due diligence before investing in securities market. I disclaim any liability for losses arising from reliance on this content.

Bank of Baroda Technical Setup

Analysis: Strong momentum above all key moving averages (50SMA, 150SMA, 200SMA) currently in Stage 2, coupled with a fresh breakout above prior highs and above average volume with positive improving RS.

Entry Range: 250-262

Upside: 25% from Entry Range

Stop Loss: 7% from Entry Range

Time Frame: 5 months

NHPC Technical Setup

Analysis: Strong momentum above all key moving averages (50SMA, 150SMA, 200SMA) currently in Stage 2, coupled a positive improving RS.

Entry Range: 89-91

Upside: 25% from Entry Range

Stop Loss: 7% from Entry Range

Time Frame: 5 months

RRG Analysis

NHPC and Bank of Baroda RRG Analysis Weekly

NHPC has started to move upwards in the "Lagging" quadrant showing early improvement in momentum while still lagging in relative strength.

Bank of Baroda sits closer to the "Leading" quadrant, demonstrating both improving strength and momentum.

NHPC and Bank of Baroda RRG Analysis Daily

NHPC has moved over last two trading days into the "Leading" quadrant, signalling strong relative strength and momentum.

Bank of Baroda remains in the "Improving" quadrant, indicating its momentum is picking up but relative strength is yet to fully emerge.

Golden Rules of Trading

RESPECT Entry Zones.

RESPECT Stop Loss.

Always favor breakouts with above-average volume.

Entering into any position beyond an entry zone is extended and increases your risk.

Always use hard stops 7–10% below entry range to protect capital.

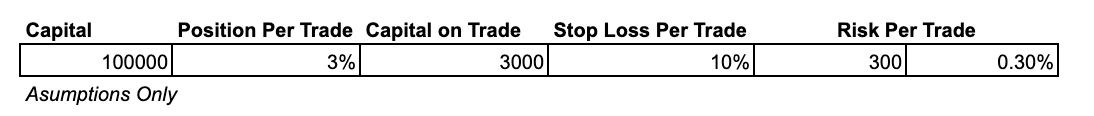

Your average risk per trade ALWAYS determines the outcome. The below chart demonstrates

Disclaimers

The content shared here reflects the personal views of Ayush Agrawal, who is registered with SEBI as an Individual Research Analyst (INH000013013, w.e.f. September 14, 2023).

All market opinions, stock ideas, and recommendations are provided purely for informational purposes and as general research under SEBI “public appearance” guidelines.

Nothing here is to be construed as personalised financial advice.

Recommendations and analyses are not tailored to individual financial circumstances, objectives, or risk profiles; they do not constitute specific advice or a contract of service.

I, Ayush Agrawal, do not currently offer any paid research or advisory services. No consideration of any kind is received for securities or products mentioned, and there is no beneficial ownership or trading position in the discussed securities in the last 30 trading days, nor is any planned within the next 5 trading days.

All information has been sourced from public data considered reliable, but accuracy, completeness, and timeliness are not guaranteed.

Manual errors or omissions may exist. Independently verify all data before investing.

Readers/investors must do their own due diligence or consult a licensed advisor before taking any action based on these views.

I, Ayush Agrawal, expressly disclaim liability for any direct or consequential losses from reliance on this content.

Registration granted by SEBI and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Investment in securities market are subject to market risks. Read all the related documents carefully before investing.

Compliance officer: Ayush Agrawal

Telephone number: +91 9425412028.

E-mail address: themicrocapinvestor@gmail.com

Contact Details

themicrocapinvestor@gmail.com

First Floor, B.P. Complex, Baldeobagh, Jabalpur, Madhya Pradesh, 482002

+91 9425412028

SEBI Research Analyst No. : INH000013013

BSE Enlistment No. : 5849