Hello Dear Reader,

Welcome to the AARD Phoenix. This is the third issue of our newsletter series at Ayush Agrawal Research where I will on a weekly basis give out 2-3 Technical Picks occasionally a Fundamental Pick.

Thanks for reading The Microcap Minute! Subscribe for free to receive new posts and support my work.

I will not want put this newsletter behind a paywall and ask you for money to ever access this letter. You can even read this newsletter if you do not subscribe to The Microcap Minute.

I also do not have plans to bore you a lot with general market commentary or send you AI based summaries of corporate announcements. For that, I have a Free WhatsApp community where I post all the important Corporate Announcements Daily. You can Join Below:

This will be a pointed newsletter where each issue will have a few picks given by a SEBI Registered RA and anyone of you, even as you read this letter years from today can access it without even subscribing to the newsletter or even giving your email or contact details. Please though remember that nothing here is to be construed as personalized financial advice. Recommendations and analyses are not tailored to individual financial circumstances, objectives, or risk profiles; they do not constitute specific advice or a contract of service. Please do your own due diligence before investing in securities market. I disclaim any liability for losses arising from reliance on this content.

Lumax Auto Technical Setup

Analysis: Textbook Stage 2 breakout with stock making new high and Close>SMA50>SMA150>SMA200 & Above average volume

Entry Range: 1257-1324

Upside: 25% from Entry Range

Stop Loss: When price closes below EMA21 OR falls 10% from entry price, whichever level is higher

Subros Technical Setup

Analysis: Textbook Stage 2 breakout with stock making new high and Close>SMA50>SMA150>SMA200 & Above average volume

Entry Range: 1072-1137

Upside: 25% from Entry Range

Stop Loss: When price closes below EMA21 OR falls 10% from entry price, whichever level is higher

Golden Rules of Trading

RESPECT Entry Zones.

RESPECT Stop Loss.

Always favor breakouts with above-average volume.

Entering into any position beyond an entry zone is extended and increases your risk.

Always use hard stops 7–10% below entry range to protect capital.

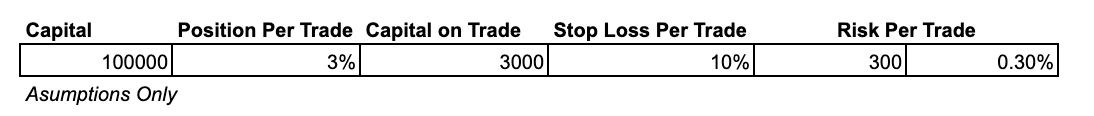

Your average risk per trade ALWAYS determines the outcome. The below chart demonstrates

Disclaimers

The content shared here reflects the personal views of Ayush Agrawal, who is registered with SEBI as an Individual Research Analyst (INH000013013, w.e.f. September 14, 2023).

All market opinions, stock ideas, and recommendations are provided purely for informational purposes and as general research under SEBI “public appearance” guidelines.

Nothing here is to be construed as personalised financial advice.

Recommendations and analyses are not tailored to individual financial circumstances, objectives, or risk profiles; they do not constitute specific advice or a contract of service.

I, Ayush Agrawal, do not currently offer any paid research or advisory services. No consideration of any kind is received for securities or products mentioned, and there is no beneficial ownership or trading position in the discussed securities in the last 30 trading days, nor is any planned within the next 5 trading days.

All information has been sourced from public data considered reliable, but accuracy, completeness, and timeliness are not guaranteed.

Manual errors or omissions may exist. Independently verify all data before investing.

Readers/investors must do their own due diligence or consult a licensed advisor before taking any action based on these views.

I, Ayush Agrawal, expressly disclaim liability for any direct or consequential losses from reliance on this content.

Registration granted by SEBI and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Investment in securities market are subject to market risks. Read all the related documents carefully before investing.

Compliance officer: Ayush Agrawal

Telephone number: +91 9425412028.

E-mail address: themicrocapinvestor@gmail.com

Contact Details

themicrocapinvestor@gmail.com

First Floor, B.P. Complex, Baldeobagh, Jabalpur, Madhya Pradesh, 482002

+91 9425412028

SEBI Research Analyst No. : INH000013013

BSE Enlistment No. : 5849