Top Down #2: Smart Meter

2nd July 2024

The Top-Down Series is a new initiative we have undertaken to make investors understand how they can distill the macro picture into action.

Investing with a top-down approach means starting at the macroeconomic level—identifying the big-picture trends—and then drilling down into the most promising sectors and stocks.

#2 Smart Meter

Nudging Towards Smarter Power Consumption

In the behavioral economics playbook, few concepts are as powerful—or as subtle—as nudge theory. Coined by Richard Thaler and Cass Sunstein, the idea is simple: rather than mandating change, shape choices in a way that steers people towards better outcomes, without eliminating freedom of choice. Maharashtra’s recent move to reduce electricity tariffs while simultaneously rolling out smart meters could be a textbook example of this in action.

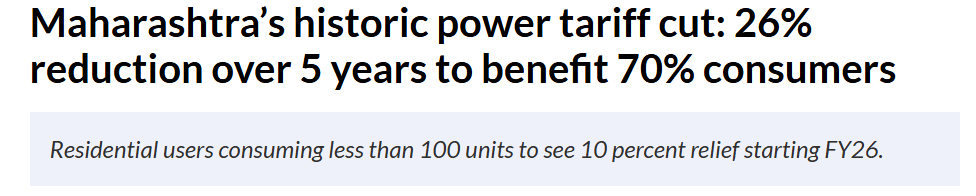

Maharashtra's Historic Tariff Reduction: The Numbers Behind the Relief

Maharashtra is witnessing a transformative period in its electricity sector, marked by an unprecedented power tariff reduction and a parallel, ambitious smart meter rollout. This dual initiative promises to reshape how millions of residents and businesses consume and pay for electricity. At the heart of this shift is the bold claim of a significant 26% reduction in power tariffs over the next five years, poised to directly benefit a vast majority—an estimated 70%—of the state's electricity consumers, particularly those in lower consumption brackets. This is a historic departure from past trends of tariff hikes, signaling a new direction for energy policy in the state.

The tariff reductions are not limited to residential consumers; they extend across various sectors, signaling a broader strategy to stimulate economic activity within the state. Industrial consumers, for example, will experience notable relief. High-tension (HT) industries are slated for a 15% reduction in FY 2025-26, followed by an additional 4% annual decline until 2029-30. Similarly, low-tension (LT) industries will see an 11% reduction in FY 2025-26, with a subsequent 3% annual drop. A significant aspect of these changes for industries is the substantial reduction in cross-subsidy charges, which aims to bring their electricity costs closer to the average cost of supply (ACoS). Furthermore, data centers and semiconductor units have been reclassified as industrial consumers, making them eligible for these lower rates and an additional 10% discount on wheeling charges if they commit to using 100% green energy.

Smart Meter Rollout: Facts & Figures (2018–2025)

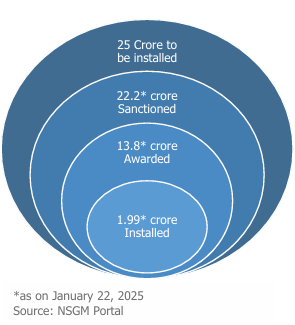

India's smart energy infrastructure is undergoing a significant transformation, with smart meter deployment emerging as a cornerstone of this evolution. Driven by ambitious national programs, particularly the Revamped Distribution Sector Scheme (RDSS) launched in 2021, smart meter installations across the country have witnessed a remarkable acceleration. Despite this momentum, a substantial gap persists between current installation rates and the ambitious national targets, indicating a projected delay in achieving universal smart metering.

Parallel to cheaper tariffs, Maharashtra is aggressively rolling out smart meters as part of a nationwide modernization push. These electronic meters automatically transmit usage data, enable prepaid or postpaid billing, and support Time-of-Day pricing – a big upgrade from traditional meters.

As of mid-2025, Maharashtra has on the order of a few hundred thousand smart electricity meters installed statewide. Precise figures are evolving monthly. For instance, by April 2025 MSEDCL had installed about 75,000 smart prepaid meters in Nagpur district alone, and over 100,000 meters in Nashik zone since Dec 2024, as the rollout picked up “war-footing” pace. Extrapolating similar progress across other zones (Pune, Konkan, etc.), sector analysts estimate several lakhs (hundreds of thousands) of smart meters were deployed across Maharashtra by mid-2025. This is still a single-digit percentage of the ~3 crore total consumers statewide. In other words, roughly 1–3% of MSEDCL customers likely had smart meters active by mid-2025.

Tariff Cuts and Smart Meters: Is There a Connection?

With both initiatives – tariff reduction and smart meter rollout – happening simultaneously, one naturally asks: are they related? Is Maharashtra cutting rates because of smart meters (through savings), or to encourage consumers to accept smart meters? We investigated policy statements and data for any correlation or causation between the two. Here’s what we found:

Efficiency Savings Enabling Tariff Relief: The tariff cut was made possible in part by improvements in MSEDCL’s cost structure. The MERC order cites factors like lower power purchase costs, reduced energy demand projections, and loss reductions allowing tariffs to come down. One major efficiency goal is to cut distribution losses from 17% to 11% by 2029-30. Smart meters are a key tool to reduce Aggregate Technical & Commercial (AT&C) losses – by improving billing accuracy, curbing power theft, and enabling timely payments. While the MERC didn’t explicitly say “we cut rates because of smart meters,” the broader narrative is that modernizing infrastructure (like metering) improves the utility’s financial health, which in turn made a tariff reduction feasible. In short, smart meter deployment is part of the efficiency improvements that help “ensure broader affordability”

Policy Incentives Tying Them Together: Importantly, Maharashtra is using tariff incentives to promote smart meters. Under the new tariff structure, domestic consumers with smart meters get an extra 10% discount on electricity used during daytime (off-peak hours), via a Time-of-Day (ToD) tariff mechanism. This is a big deal: it directly links owning a smart meter with saving more money. MERC approved Time-of-Day billing for residential users – something only feasible with smart meters tracking when energy is used. So a household that allows MSEDCL to install a smart meter stands to benefit not just from the general tariff cut, but also from potentially lower rates if they shift usage to daylight hours. This policy-driven linkage is clearly spelled out: “domestic consumers with smart meters will receive an additional 10% discount for daytime usage under the ToD tariff.” In essence, the government is sweetening the deal for smart meter adoption by coupling it with lower bills.

It’s too early for hard statistical correlations (the full meter rollout is ongoing, and the tariff cuts have just begun). However, the phasing aligns: as smart meter penetration is expected to rise sharply by 2026 (RDSS target), the tariff is scheduled to progressively drop through 2030. Both are five-year plans aimed at 2025–2030. The MERC has built in expectations of loss reduction each year in its tariff. Achieving those loss reductions presumably depends on smart metering among other measures. If smart meter rollout were to stall, it could jeopardize the utility’s financial projections, potentially affecting the tariff trajectory in later years.

Maharashtra’s simultaneous push for lower tariffs and wider smart meter adoption is not just an energy policy success; it’s a signal of a deeper structural shift in India’s power sector. At the core lies a compelling investment narrative: smart meters are no longer a future promise; they are a present imperative.

Disclaimer

All information is sourced from publicly available data, and while every effort has been made to ensure the accuracy and reliability of the information provided in these notes from the management meeting, Ayush Agarwal Research cannot guarantee that the information is complete or free from errors.

I, Ayush Agrawal, am registered with SEBI as an Individual Research Analyst under the registration number INH000013013, effective from September 14, 2023.

I offer paid research services to my clients based on this certification. Opinions expressed otherwise regarding specific securities are not investment advice and shall not be treated as recommendations. Neither I nor my associates/ employees shall not be liable for any losses incurred based on such opinions.

All matter displayed in this content is purely for Illustrative, Knowledge and Informational purpose and shall not be treated as advice or opinion of any kind.

The content presented should not be construed as investment advice unless explicitly stated in a client-specific research report. I or my employees/associates shall not be held liable/responsible in any manner whatsoever for any losses the readers may incur due to acting upon this content.

All information is taken from publicly available sources and data. I make no warranties or guarantees regarding the accuracy, completeness, or timeliness of the information provided, including data such as news, prices, and analysis. In no event shall I be liable to any person for any decision made or action taken in reliance upon the information provided by me.

We cannot guarantee the completeness or reliability of the information presented. Readers are encouraged to conduct their own research and consult with a professional advisor before making any investment decisions.