Unlisted vs Listed Companies: A Comparative Analysis

15th January 2025

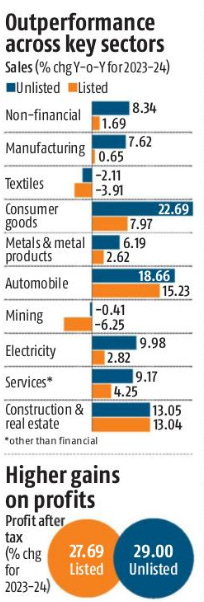

In the dynamic business landscape, unlisted companies are increasingly outperforming their listed peers across key financial metrics such as sales, earnings growth, and capacity expansion. The emerging trend highlights the resilience and adaptability of unlisted entities in navigating regulatory challenges and leveraging growth opportunities.

1. Sales and Earnings Growth: The Unlisted Advantage

Unlisted companies have recorded significantly higher revenue and profit growth than listed firms in FY24. According to the Centre for Monitoring Indian Economy (CMIE):

Revenue Growth: Unlisted firms reported an impressive growth of 8.34%, compared to a modest 1.69% for listed peers.

Profit After Tax: While listed firms showed a growth of 27.69%, unlisted companies surged ahead with a 29% increase.

Source: Business Standard

Sectoral Insights

The manufacturing sector has been a key driver for unlisted companies, with a growth of 7.62%. Other sectors such as consumer goods, metals, and mining also showed robust performance. Interestingly, unlisted firms have also been agile in adopting innovative technologies and capturing market share, contributing to their rapid growth trajectory.

2. Financial Stability: A Strong Foundation for Unlisted Firms

The financial resilience of unlisted companies is evident in their superior interest coverage ratios and debt management.

Interest Coverage Ratio: At 2.94, the ratio for unlisted firms is the highest in three decades, signaling their robust earnings capacity to manage debt obligations.

Debt-Equity Ratio: Unlisted companies have managed to maintain their leverage efficiently, with a ratio of 1.10, reflecting prudent financial strategies.

Source: Business Standard

Borrowing Trends

Unlisted firms have been proactive in leveraging debt for expansion, as evidenced by a 6.09% rise in borrowings in FY24. However, their borrowing costs remain competitive, enhancing their overall financial stability.

3. Capacity Expansion: Outpacing Listed Counterparts

Unlisted firms are not only achieving faster sales growth but are also adding capacity at a remarkable pace. In FY24:

Net Fixed Assets Growth: Unlisted firms recorded a growth of 7.5%, surpassing the 6.4% growth of listed firms.

Capital Work in Progress: Unlisted entities showed a 6.9% increase, compared to just 0.3% for listed companies.

Source: Business Standard

Sectoral Highlights

Aviation and Electricity: These sectors witnessed the highest growth in fixed assets for unlisted companies.

Consumer Goods and Real Estate: The ongoing investment in these sectors highlights the broad-based commitment of unlisted firms to capacity expansion.

Driving Factors

Unlisted companies have been quick to capitalize on emerging opportunities, driven by:

A focus on niche markets.

Flexibility in adopting innovative business models.

Strong funding support from private investors.

4. Regulatory Environment: Easing the Path for Growth

The government’s efforts to ease compliance and review redundant regulations are expected to benefit both listed and unlisted companies. The focus on reducing regulatory hurdles will enhance the ease of doing business, fostering innovation and growth.

Impact on Unlisted Firms: Regulatory relaxation will further empower unlisted entities to explore aggressive growth strategies.

Support for Listed Firms: The simplification of rules will also enable listed companies to compete effectively.

The unlisted vs listed debate underscores a broader narrative about the changing dynamics of the corporate world. While listed companies continue to offer stability and regulatory transparency, unlisted firms are redefining growth benchmarks with their agility and innovation.

As regulatory norms evolve and markets mature, the lines between these two categories may blur, offering a more inclusive ecosystem for businesses. For now, unlisted companies are undeniably stealing the spotlight, proving that agility and innovation are the new mantras for success.

Disclaimer

All information is sourced from publicly available data, and while every effort has been made to ensure the accuracy and reliability of the information provided in these notes from the management meeting, Ayush Agarwal Research cannot guarantee that the information is complete or free from errors.

I, Ayush Agrawal, am registered with SEBI as an Individual Research Analyst under the registration number INH000013013, effective from September 14, 2023.

I offer paid research services to my clients based on this certification. Opinions expressed otherwise regarding specific securities are not investment advice and shall not be treated as recommendations. Neither I nor my associates/ employees shall not be liable for any losses incurred based on such opinions.

All matter displayed in this content is purely for Illustrative, Knowledge and Informational purpose and shall not be treated as advice or opinion of any kind.

The content presented should not be construed as investment advice unless explicitly stated in a client-specific research report. I or my employees/associates shall not be held liable/responsible in any manner whatsoever for any losses the readers may incur due to acting upon this content.

All information is taken from publicly available sources and data. I make no warranties or guarantees regarding the accuracy, completeness, or timeliness of the information provided, including data such as news, prices, and analysis. In no event shall I be liable to any person for any decision made or action taken in reliance upon the information provided by me.

We cannot guarantee the completeness or reliability of the information presented. Readers are encouraged to conduct their own research and consult with a professional advisor before making any investment decisions.