Exploration of India’s Textile Industry

21st August 2024

Indian Textile Industry Overview

The Indian textile industry is a vibrant and robust sector that spans the entire value chain—from fiber production to yarn, fabric, and apparel manufacturing. This industry is characterized by its diversity, ranging from traditional handloom and handicrafts to modern, organized manufacturing units that produce wool, silk, and synthetic products. As a key player in the global market, India’s textile sector continues to be a significant contributor to the country’s GDP and employment.

A Brief History of the Indian Textile Industry

The roots of India’s textile sector trace back to the mid-1800s. The first cotton mill in Mumbai was established in 1854, followed by Ahmedabad’s first mill in 1861. Over the years, the number of mills grew steadily, leading to the creation of several initiatives to enhance industry efficiency:

Technology Upgradation Fund Scheme (1999): Facilitated capital access for technological enhancements.

National Textile Policy (2000): Focused on the holistic development of the sector.

Scheme for Integrated Textile Parks (2005): Supported infrastructure development for textile units.

These efforts laid the groundwork for modern growth, further propelled by the post-MFA (Multi-Fibre Arrangement) period, free trade agreements, and the advent of technical textiles.

Key Segments and Market Structure

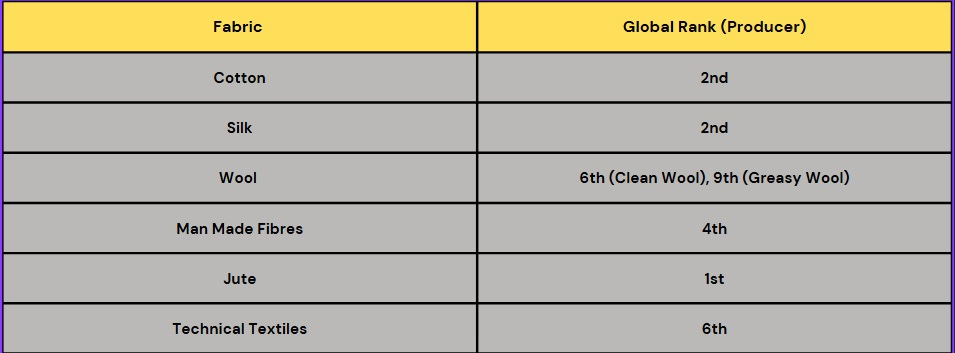

The Indian textile industry operates across several segments:

Spinning and Yarn Making: The backbone of fabric production, requiring high capital investment but offering scale economies.

Fabric Manufacturing: Converts yarn into cloth, with companies focusing on either B2B or B2C sales.

Apparel Manufacturing: Involves less capital but is labor and inventory intensive. Larger manufacturers often enjoy direct brand partnerships.

Challenges and Competitive Landscape

The sector is highly fragmented, dominated by small-scale players, especially in spinning and fabric making. Despite the low entry barriers, intense competition limits pricing power across the value chain, allowing only premium brands and differentiated products to command higher margins.

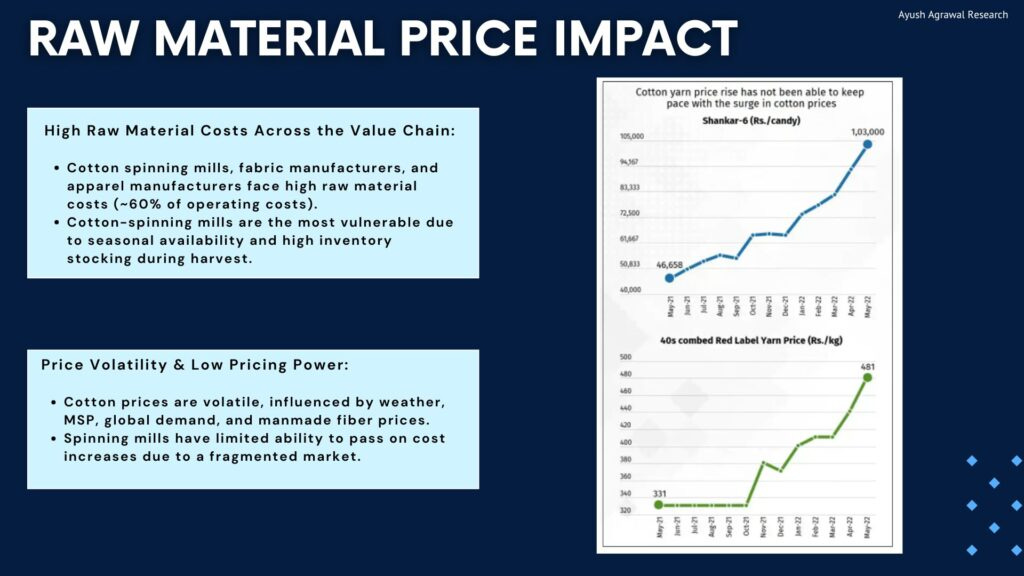

Capital Intensity and Raw Material Costs

A significant aspect of the industry’s operation is its capital-intensive nature. From spinning to garment manufacturing, each segment has specific capital and inventory requirements:

Spinning Segment: High fixed capital needs (e.g., ₹90-100 crore for a 25,000 spindle unit) and working capital for inventory.

Fabric Manufacturing: Demands substantial investment in plant machinery and inventory management.

Apparel Segment: While less capital-intensive, it requires meticulous inventory management due to fast-changing fashion trends.

High raw material costs, particularly in cotton spinning, make this industry vulnerable to price volatility driven by global demand, weather conditions, and policy changes.

Government Initiatives and Policy Support

The government has consistently pushed for the growth and modernization of the textile sector:

PM MITRA Parks Scheme: Launched to establish seven mega textile parks. 5F Vision: Envisions a complete value chain from “farm to fashion to foreign,” focusing on integrated development.

PLI Scheme: Aims to enhance global competitiveness, create jobs, and attract investments worth Rs. 19,000 crore (US$ 2.4 billion).

Global Competition and the Path Ahead

While India has a strong presence, it faces stiff competition from countries like Bangladesh and Vietnam. These nations benefit from more flexible labor laws, lower wages, and favorable trade agreements, particularly with the EU. However, India has the opportunity to gain market share, especially in light of shifting global dynamics and increased foreign investments in its textile sector.

Conclusion

India’s textile industry is on a growth trajectory with the right mix of policy support, technological advancements, and a growing domestic and global market. As the sector expands and modernizes, it is poised to not only maintain but also enhance its position as a global textile leader.

Ayush Agrawal

Research Analyst

SEBI Registration No. INH000013013

First Floor, B.P. Complex, Baldeobagh,

Jabalpur, Madhya Pradesh, 482002

Email: themicrocapinvestor@gmail.com

Number: +91 9425412028

GST Number: 23AHUPA5526E2ZJ

General Disclaimer

I, Ayush Agrawal, am registered with SEBI as an Individual Research Analyst under the registration number INH000013013, effective from September 14, 2023.

I offer paid research services to my clients based on this certification. Opinions expressed otherwise regarding specific securities are not investment advice and shall not be treated as recommendations. Neither I nor my associates/ employees shall not be liable for any losses incurred based on such opinions.

Any matter displayed in this content is purely for Illustrative, Knowledge and Informational purpose and shall not be treated as advice or opinion of any kind. The content presented should not be construed as investment advice unless explicitly stated in a client-specific research report. I or my employees/associates shall not be held liable/responsible in any manner whatsoever for any losses the readers may incur due to acting upon this content.

Among other things, the content includes case studies and summarised exchange filings, like result updates, order updates, fund raise updates, mergers, JVs and acquisitions, subsidiary incorporations, capex announcements, signing of MOUs, new product launches, bulk/ block deals, among other types of filings. The source of these filings is from publicly available data on NSE/ BSE exchanges.

The information is taken from publicly available sources and public data. I make no warranties or guarantees regarding the accuracy, completeness, or timeliness of the information provided, including data such as news, prices, and analysis. In no event shall I be liable to any person for any decision made or action taken in reliance upon the information provided by me.

I do not hold any positions in the securities mentioned, nor have I traded in these securities in the past 30 trading days. I also do not plan to trade in the next 5 trading days.

Paid clients receive detailed research reports and detailed analysis on all my research. For stock/ company specific investment recommendation, visit https://ayushagrawal.in/services to know about my paid research services.

The updates do not constitute a recommendation to buy/ sell and are for illustrative and for general informational purposes.

Link To Join Our Telegram Community - https://t.me/microcapminute